When is the best time to plan for the future, YOU want? NOW! Whether you are just now turning sixty-five or you already have Medicare and are wondering if you need to select a different Medicare plan for the remainder of 2024, we have the Highest-Rated Medicare Plans available NOW.

… CONTACT US TODAY!!

Taking steps to maintain an independent life!

Benjamin Franklin once said, “Success is the residue of planning.”

Contact me NOW to help assure your coverage for 2023.

What Can We Do?

It has been said that “by failing to plan, you are preparing to fail” (–Benjamin Franklin). NOW is the time to begin planning for retirement. For most of us, the closer you get to retirement, the more disconcerting this life-step becomes. Beginning the process early reduces the pressure to get everything right immediately. The good news, while options are reduced as time passes, it’s really never too late to review the process… even AFTER retiring it is very likely there are several things you can still achieve or improve.

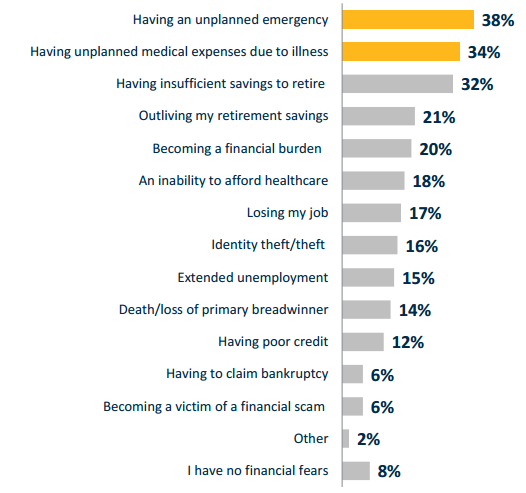

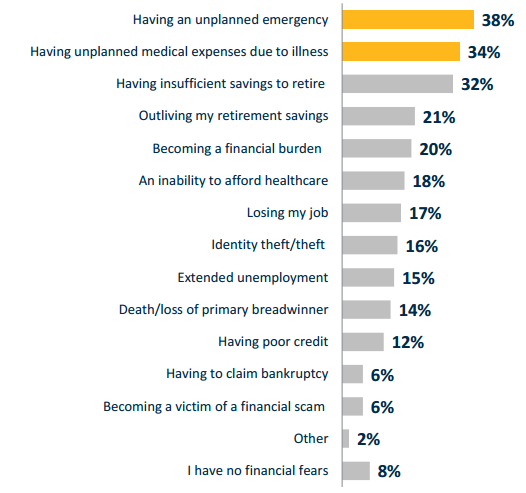

Take a look at the following survey results from a Northwestern Mutual study which included Retirement Concerns from 2624 individuals.

we can help...

Of these fourteen “retirement concerns”, we are able to help you to minimize or eliminate the top six… and maybe a few more. If you have questions about any of the following areas contact us.

Medical Insurance Under 65

Health Insurance Marketplace — also known as the Health Insurance Exchange — is the place where people without health care insurance can find information about health insurance options and also purchase health care insurance. You can go to Healthcare.gov or shop for other non-substandized health insurance. Contact us for additional options.

medical insurance over age 64

Medicare is the nation’s health insurance for those over 65 that are no longer covered by an employer group plan or are disabled with specific diseases. If your employers health plan is “creditable” under Medicare rules, you may delay beginning Medicare until you leave active employment. Contact us today to help select the best options and timing to fit YOUR need and expectations.

Dental Insurance

Compared to traditional health insurance, dental insurance plans can be relatively simple. They can also be a lot less expensive. Still, it’s an important health care investment, and you want to get the dental policy that works best for you. Dental plans’ coverage increases over time. The only way to get comprehensive individual dental coverage is to select your plan today! Contact us for personalized help and additional options.

Life Insurance and Final Expense

A few years ago I realized the normal pattern of life is to live a “productive life”, retire and live out your senior years only to get sick, run up a large medical bill, receive an expensive funeral, and leave a stack of bills behind for those for whom you cared the most.

Perhaps you own a business and want to, on your passing, finance a way to keep it running; provide a continuing income for your family, and fund it’s operation till it can be sold or transferred to a partner.

There are many, many reasons to have life coverage for you and those important to you. Your planning “puzzle” isn’t complete till the need for life insurance is included. Contact us today, so we can start that conversation now. This is the best time.

income for the rest of your life

Outliving your income has been a problem for seniors in most cultures throughout history. In America today, Social Security is sometimes mistakenly thought to solve this need. The 12% of Americans whos only income is Social Security will tell you that isn’t enough. Let us help you solve the retirement income puzzle. Contact us today to begin developing a plan to provide a LIFETIME income for you.

extended and personal care

*For 70% of the population 65 years old, the need for long term care is almost a certainty. At any age, accident, injury, or illness can create physical or mental challenges that create the same needs. The great news is that there are options today that are much more favorable for consumers. Also, all of these new options provide care IN-HOME. Contact us now to see these new more attractive extended care options.